Cash Flow To Creditors Equals

Formula to Calculate Operating Cash Period (OCF)

The Operating Cash Menstruation Formula signifies the cash menses generated from the core operating activities of the business organisation after deducting the operating expenses. It helps in analyzing how strong and sustainable is the business model of the company.

Operating cash menstruation (OCF) measures the cash that a business produces from its primary operation in a specific period. Information technology is also known equally cash flow from operations. Information technology is not the same every bit net income neither EBITDA nor free greenbacks menstruum The cash flow to the house or equity subsequently paying off all debts and commitments is referred to as free cash menstruation (FCF). It measures how much cash a house makes after deducting its needed working capital and upper-case letter expenditures (CAPEX). read more . Still, all are used for measurement of performance of a visitor as cyberspace income includes a transaction that did not involve the actual transfer of coin similar depreciation which is a non-greenbacks expense that is function of net income Net income for individuals and businesses refers to the corporeality of coin left later subtracting direct and indirect expenses, taxes, and other deductions from their gross income. The income statement typically mentions information technology every bit the concluding line item, reflecting the profits made past an entity. read more not of OCF.

There are two formulas to calculate Operating Greenbacks Flow – one is a direct method, and the other is an indirect method.

Table of contents

- Formula to Calculate Operating Cash Flow (OCF)

- #1 – Direct Method (OCF Formula)

- #2 – Indirect Method (Operating Cash Flow Formula)

- Explanation

- Components

- Practical Examples of Calculating Operating Greenbacks Flow

- Instance #1

- Example #2

- Case #3

- Things to Remember

- Operating Cash Flow Calculator

- Recommended Articles

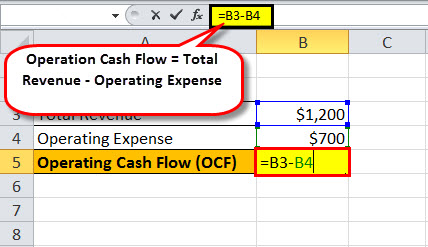

#1 – Direct Method (OCF Formula)

This method is very simple and accurate. But as it does non provide much detailed information to the investor, companies utilise the indirect method of OCF. OCF is equal to Total acquirement minus Operating expense.

The formula to calculate OCF using the directly method is every bit follows –

Operating Cash Menses = Full Revenue – Operating Expense

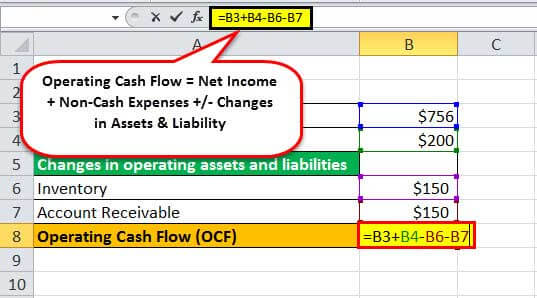

#2 – Indirect Method (Operating Cash Menstruation Formula)

The indirect method is adjusted net income from changes in all non-cash accounts on the balance sheet A balance canvas is one of the fiscal statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner's capital equals the total avails of the company. read more . For case, depreciation is added to net income while adjusting changes in inventory and cash receivable. OCF calculates with net income, adds any not-cash detail, and adjusts for changes in internet capital. This provides total greenbacks generated

Operating Cash Menses formula using the indirect method can be represented every bit follows –

Operating Cash Flow = Net Income +/- Changes in Assets Liability + Non-Cash Expenses

You are free to utilise this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Operating Cash Flow Formula (wallstreetmojo.com)

Explanation

At present, permit us see the main steps required to calculate the Operating Greenbacks Menses.

- Net income is considered as a starting bespeak.

- All non-cash items are added Not-cash expenses are those expenses recorded in the house's income statement for the period under consideration; such costs are not paid or dealt with in cash by the firm. Information technology involves expenses such as depreciation. read more like depreciation, Stock-based compensation Stock-based compensation likewise chosen share-based compensation refers to the rewards given by the company to its employees past way of giving them the equity ownership rights in the visitor with the motive of aligning the involvement of the management, shareholders and the employees of the company. read more , other expense or other income, deferred taxes.

- Changes in working capital adjustment that includes inventory account receivable and unearned revenue Unearned revenue is the advance payment received by the house for goods or services that have yet to exist delivered. In other words, information technology comprises the corporeality received for the goods delivery that will take place at a future date. read more than ;

The full formula of Operating Cash Period is as follows:-

OCF = Net Income + Depreciation + Stock-Based Compensation + Deferred Taxation Deferred Tax is the effect that occurs in a house as a upshot of timing differences between the date when taxes are actually paid to taxation authorities by the visitor and the appointment when such taxation is accrued. Only put, information technology is the departure in taxes that arises when taxes due in one of the accounting flow are either non paid or overpaid. read more + Other non-cash items – Increase in Business relationship Receivable – Increase in Inventory + Increment in Accounts Payable + Increase in Accrued Expenses + Increment in Deferred Revenue

Components

Let'due south analyze the various component of the OCF Formula, which are as follows:-

- Net income is base income, it is a requirement.

- Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset'due south worth has been utilized. Depreciation enables companies to generate revenue from their assets while just charging a fraction of the toll of the asset in employ each year. read more helps to account for expensive property, plant, mechanism, etc.

- The payment of Stock-based compensation is in non-greenbacks form like in the course of shares.

- Other expense/income includes unrealized gains or losses Unrealized Gains or Losses refer to the increase or decrease respectively in the newspaper value of the company'due south unlike assets, even when these avails are non yet sold. Once the avails are sold, the company realizes the gains or losses resulting from such disposal. read more .

- Deferred Taxation is a difference in revenue enhancement which the company paid and its financial statements Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, half-dozen monthly or yearly). These statements, which include the Balance Canvass, Income Statement, Cash Flows, and Shareholders Disinterestedness Statement, must exist prepared in accordance with prescribed and standardized bookkeeping standards to ensure uniformity in reporting at all levels. read more .

- Inventory is reduced in an OCF as an inventory increment leads to a subtract in cash.

- Accounts receivable is subtracted as an increase in account receivable reduces the cash, which means that a customer does not pay the amount.

Hence, in short, the OCF formula is:-

Practical Examples of Calculating Operating Greenbacks Flow

You lot tin can download this Operating Cash Flow Formula Excel Template here – Operating Cash Period Formula Excel Template

Instance #1

Suppose there is a company with a total acquirement of $i,200 and an overall operating expense Operating expense (OPEX) is the toll incurred in the normal course of business and does non include expenses directly related to production manufacturing or service delivery. Therefore, they are readily available in the income statement and assistance to decide the net turn a profit. read more of $700. If i wants to summate Operating Cash Flow, the Direct method will be used.

In the template below is the data for the adding of Operating Cash Menses.

| Particulars | Amount |

|---|---|

| Total Revenue | $1,200 |

| Operating Expense | $700 |

| Operating Cash Flow (OCF) | ? |

And so, the calculation of Operating Cash Flow (OCF) will be as –

i.eastward. OCF Straight = 1,200 – 700

And then, OCF will exist –

Therefore, OCF = $500

Example #ii

Suppose a company has a net income of $756, a non-cash expense of $200, and changes in asset-liability, i.e., inventory is $150, account receivable Accounts receivables is the money owed to a business by clients for which the business concern has given services or delivered a product but has not yet collected payment. They are categorized as electric current assets on the balance sheet as the payments expected within a year. read more $150. Then, Operating Cash Flow Cash menses from Operations is the first of the three parts of the cash flow statement that shows the greenbacks inflows and outflows from core operating business in an bookkeeping year. Operating Activities includes cash received from Sales, greenbacks expenses paid for direct costs as well as payment is done for funding working capital. read more through the indirect method will exist every bit follows:-

The below template is the data for the adding of the Operating Cash Menstruation Equation.

| Particulars | Amount |

|---|---|

| Net Income | $756 |

| Not- Cash Expense | $200 |

| Changes in Operating Assets and Liabilities | |

| Inventory | $150 |

| Business relationship Receivable | $150 |

| Operating Cash Flow (OCF) | ? |

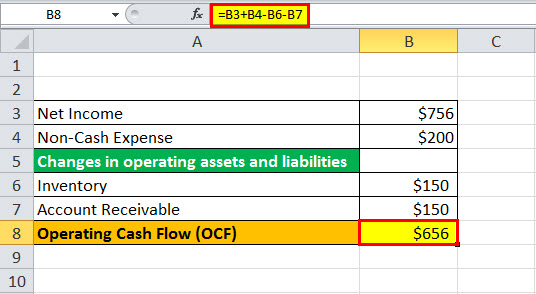

So, the calculation of Operating Cash Menstruation (OCF) using the indirect method will exist as –

i.e. OCF Indirect = 756 + 200 – 150 – 150

Then, OCF volition exist –

OCF = $256

GAAP requires a visitor to use an indirect method to compute the figure every bit it gives all the necessary information and covers the same.

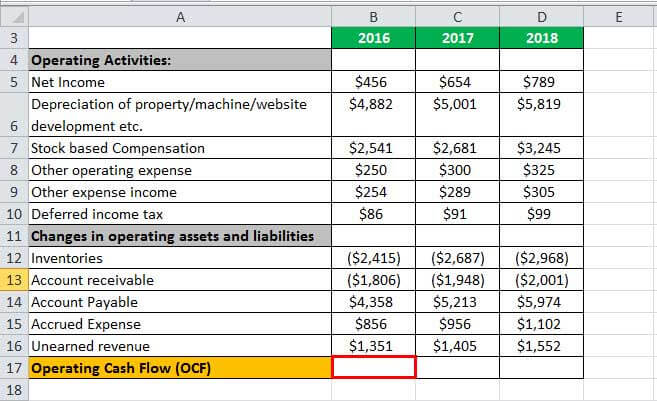

Example #3

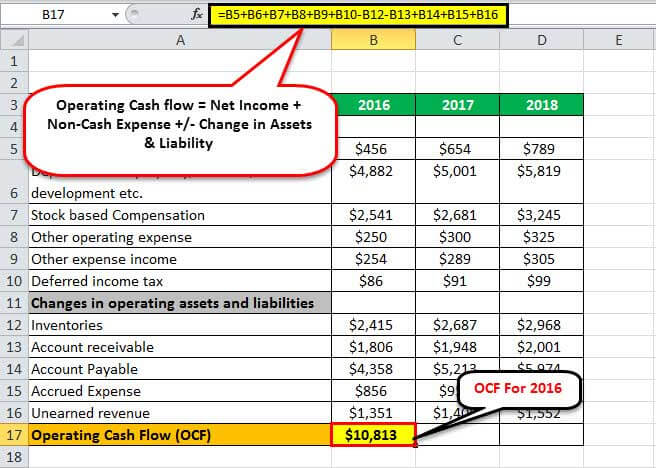

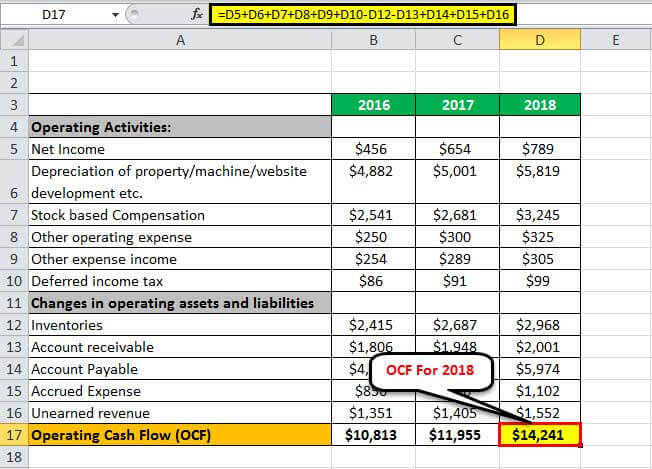

A company named Ozone Pvt. Ltd has financial statements in three sections, i.e., operations activities, finance activities The various transactions that involve the move of funds between the visitor and its investors, owners, or creditors in order to reach long-term growth are referred to as financing activities. Such activities can be analyzed in the financial department of the company's cash flow argument. read more , and investing activities. Below is an operational action financial argument through which we accept to calculate Operating Cash Flow.

At present, allow'south calculate OCF for unlike periods using the above-given data.

OCF For 2016

OCF2016 = 456 + 4882 + 2541 + 250 + 254 + 86 – 2415 – 1806 + 4358 + 856 + 1351

OCF2016 = $ 10,813

OCF For 2017

OCF2017 = 654 + 5001 + 2681 + 300 + 289 + 91 – 2687 – 1948 + 5213 + 956 + 1405

OCF2017 = $ 11,955

OCF For 2018

OCF2018 = 789 + 5819 + 3245 + 325 +305 + 99 – 2968 – 2001 + 5974 + 1102 + 1552

OCF2018 = $ xiv,241

Hence, we found OCF for a different menses of a company.

Things to Remember

- If OCF is negative, it means a company has to borrow money to practise things, or it may not stay in business, simply information technology may do good the company in the long term.

- It may be possible that a company has a college cash period than net income. In this scenario, information technology is possible that a company is generating huge revenue simply decreases them with accelerated depreciation on the income statement Depreciation is a systematic resource allotment method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset's worth has been utilized. Depreciation enables companies to generate acquirement from their avails while just charging a fraction of the cost of the asset in use each year. read more .

- When cyberspace income is higher than OCF, it may be possible that they accept a difficult fourth dimension collecting receivables from the client. As depreciation is added to the OCF formula, depreciation does not touch on OCF.

- Investors should choose a company with high or improving OCF just low share prices. A company tin face up loss or small profit due to large depreciation. Even so, it can have a strong cash flow since depreciation is an accounting expense only not in cash form.

Operating Cash Menstruum Calculator

You tin can use the following calculator for the calculation of Operating Cash Flow.

| Total Revenue | |

| Operating Expense | |

| Operating Cash Flow Formula | |

| Operating Cash Flow Formula = | Total Revenue – Operating Expense |

| 0 – 0 = | 0 |

Recommended Articles

This has been a guide to the Operating Cash Menses Formula (OCF). Hither we learn how to summate cash flow from operations using two formulas (Direct & Indirect Method) and practical examples downloadable excel template and calculator. You can learn more nigh financial analysis from the following manufactures –

- Cash Flow from Operations Ratio The cash menses from operations ratio depicts the business firm's efficiency to generate cash from its concern operations to encounter its short-term obligations. It includes ciphering of enterprise value to greenbacks flow from operations ratio, greenbacks returns on assets and cash flow to debt ratio. read more

- Summate Complimentary Cash Flow Formula

- Direct vs Indirect Greenbacks Flow – Differences

- Calculate FCFF FCFF (Free cash flow to firm), or unleveled cash flow, is the cash remaining later depreciation, taxes, and other investment costs are paid from the revenue. It represents the amount of cash flow available to all the funding holders – debt holders, stockholders, preferred stockholders or bondholders. read more

Cash Flow To Creditors Equals,

Source: https://www.wallstreetmojo.com/operating-cash-flow-formula/

Posted by: wedelyoust1985.blogspot.com

0 Response to "Cash Flow To Creditors Equals"

Post a Comment